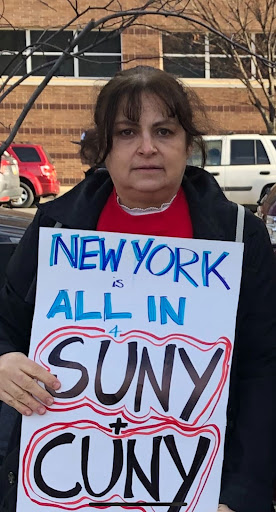

I am a student at the College of Staten Island. Where I live, the bus takes really long. Sometimes the bus doesn’t even stop. It’s a very common experience. I have classes on Tuesdays and the bus gets so full that they don’t even stop. I take two buses, so that bus made me late for class. I take the bus everyday to get around. Lower fares would make a huge difference, especially because they raise the price. It all adds up every day, week, and month.

Charlene Perez, College of Staten Island

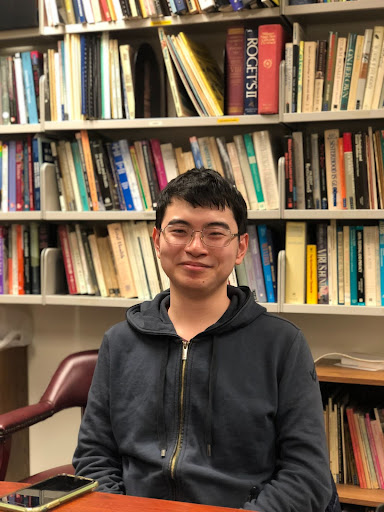

Andy Huang, Hunter College

I am a senior studying chemistry at Hunter College. I chose to attend a CUNY because it was much more affordable than a SUNY or private college. I live with my parents as dorming would be too expensive. I am lucky to receive the Pell Grant and TAP, both of which help cover my tuition fees. I also receive a scholarship per semester that helps fund my transportation, school materials, and food. While I rely on financial aid, I have come close to losing it during several semesters. This semester specifically, I was stressed about financial aid because I lost TAP. I couldn’t receive it because I was not taking enough eligible credits (the classes I needed to take were locked to the spring semester). I hope to see TAP’s eligibility expand in the future so that it accepts all the classes that students take. Attending college and getting a degree should not be blocked by tuition fees. Students need to be able to focus more on studying instead of stressing about working part-time/full-time to attend their classes.

Caroline Scott, SUNY Cortland

I attend SUNY Cortland as a full-time student. I’ve been here for two years and attended SUNY Broome my freshman and sophomore year. When applying for college I didn’t know where I wanted to go, but I knew that I didn’t want to be that far from home. That’s why I decided on Broome because it’s about 30 minutes from home. I was able to live off campus and not commute so I was able to get a real college experience. After two years there I decided to go to Cortland because it was far from my home where I am able to be independent, but still close enough to go home if I need to. I am able to go to Cortland without having to have student loans because my parents can pay for it in full. That is a reason why I chose Cortland because I wouldn’t have student debt. Cortland comes with a lot of expenses though whether it’s parking, the price of textbooks (which I don’t always need), or materials teachers make us get outside of the classroom. My major is important to me so I will do whatever it takes to obtain my degree, but the price for many things have gotten out of control and I believe all SUNYs need to look at their finances and think about their students.

Ines Schmitt, Hunter College

I am a senior at Hunter College and a Psychology major. I am a mother of three going back to school now my children are grown up and would like to help young people since when I was young I didn’t have that support. I was at BMCC my first two years and I got my associate’s degree. It was really nice because I didn’t have to worry about the burden of paying for my tuition books and transportation since I had ASAP with an unlimited metrocard and I had an excellent adviser. Unfortunately when I transferred to Hunter I didn’t have the same experience with the advisement. They made me take a class that I already took in BMCC and I felt that the adviser didn’t take me seriously. I had to take that class online with 300 other students and I didn’t learn anything since the professor couldn’t take the time to explain. I think one of the changes that CUNY could benefit from is extending ASAP since it is a great program to hire more advisers that care about students instead of making it more difficult. Fixing the heating system since sometimes the professor had to let us leave because it was too hot and there wasn’t anybody to put the heating down. I think going to university shouldn’t be a struggle and administration should help us to navigate the system.

Milen Paulose, Purchase College

I am a junior at SUNY Purchase studying Literature. I hope to go to law school afterwards. My family feels pretty unstable financially, and college is both a hope and a hurdle. I moved back to New York from Texas in 2021 and I am having trouble with my residency and it is affecting my financial aid; I feel the system is too difficult to navigate by myself. Although my parents support me by helping me commute to my university and paying for my education after aid, it is becoming difficult. I have a part-time job on campus but I am looking for another job on campus. SUNY Purchase is a fantastic university and while it was one of my top schools, one of the major reasons it ranked so high was because I could commute there. With the financial aid packages, on-campus housing was simply not an option for me. I wish there were more virtual options for classes since I have to commute from pretty far and more options for classes, since few classes for my degree are actually offered in a semester. A lot of the offered classes also overlap in their timing, so I can only pick one among many classes I would have liked to take and would help fulfill my degree requirements. I have come to love many things about college here.

Sylvie Ledain, NYC College of Technology

I began at the Borough of Manhattan Community College in the early 2000s, and applied for FAFSA and Pell. Unfortunately at the time, I did not know what career path I wanted to choose and advisement was not really very helpful with mapping a future goal. It took me almost four years to complete my Associates Degree in Liberal Arts. Unknown to me at the time, the Pell grant offers “no more than 12 terms or the equivalent.” After graduating from BMCC, I began my first legal job at a personal injuries firm. I took a very long time before attending college again, but when I finally did I applied to City Tech with the intention to learn more about the field I was working in. I have been at City Tech since spring 2021 and was recently informed that I am no longer eligible for any Federal financial aid due to my maximum limit being reached. This semester alone has been especially hard due to my brother’s sudden passing and the expenses tied to it, along with being a single mom to a 13 year old boy and having a full time job to pay for living expenses. Paying tuition seems like an unreasonable situation for me. As a current student on the Dean’s List with only one more semester before graduation, it’s disappointing to know that I may not be able to “afford” to finish my degree.

Damien Andrade, Borough of Manhattan Community College

I am in my third year at BMCC. I am graduating this semester and I am transferring to Brooklyn College to pursue a BA in Political Science. As of right now, I have financial aid to pay for the costs of college. I was nervous about this semester because I am a part time student and I didn’t know how I would pay for college without TAP. When TAP eligibility was expanded to part time students it really helped me. When I transfer to Brooklyn College, I will have to pay more for the cost of school because my financial aid won’t cover it all. I am currently working and when I transfer I will be a full time student and I am expecting a heavier workload. I will have to balance being a full time student while working 30 hours a week. Even now, as a part time student I feel like I have to pick between focusing on work to pay my expenses and focusing on school. If we had a New Deal 4 CUNY, I would be able to use the money that I am making at work for actual living expenses, not college. I wouldn’t have to work as many hours and I could focus on school. It is especially difficult now with inflation and the pandemic, because students are struggling with food, rent and education. This plays into mental health and stress. There are not many resources on campus to help with students’ mental health. My current advisors and counselors seem like they have too many students to care about me when I am in a meeting with them.

Justin Lorenzo, Purchase College

I’m a junior and intern for NYPIRG at SUNY Purchase College. I am a communications major and Economics minor. When I graduate I hope to pursue the sports advertising business. What inspired me to choose my major and minor was my love for baseball and wanting to work for a professional Sports team in the future. I currently use loans to pay for College. I’ve used TAP twice and have had a positive experience with it. I have 4 siblings and I am currently the 3rd one who has attended college. As of financial aid, it does cover me fully with loans. I usually work full time in the summer to catch up with the loans. I’m not worried about paying my loans, Just worried about what career I will have.

Kendice Marshall, Borough of Manhattan Community College

I am a senior at BMCC and I am majoring in Political Science. I plan on attending a four year college afterwards in order to get a bachelor’s degree in Political Science. I really want to get an education in order to achieve my dream of becoming a lawyer. However, college is extremely expensive and I come from a low income family. My parents are not citizens of the United States which means that I don’t qualify for FASFA or financial aid of any kind. I spend a lot of time looking for scholarships to help my parents pay for my education but it is difficult to get scholarships. So my parents have to pay for my whole education out of pocket. They insist that I do not get a job, so I can focus on my education. This puts them in a stressful situation and they are having a hard time paying for everything. I am a first generation college student and all I want is to get a quality education. If college was free, my parents wouldn’t have to have this financial burden weighing on their shoulders.

Donald Glivens, Borough of Manhattan Community College

I am a senior at BMCC and I am majoring in Business Management. I am planning on continuing my education at a four year college to get my bachelor’s degree. I live with my parents, but they can’t afford to pay for my college expenses. So I have to take out loans in order to pay for my education. I take out subsidized loans through FASFA. It covers all of my school expenses but it doesn’t cover my textbooks, transportation, or food. Also, I have to help support my family, so I have to work two jobs to afford other expenses. This makes it difficult for me to concentrate on my education. In order to graduate I needed to take a certain class that wasn’t offered my last semester. This forced me to take out more loans because I had to go to school for an extra semester. I am really worried about paying these loans back in the future. I wish they would make college free for everyone, so I wouldn’t have to be so overwhelmed about paying for my education.