I’m a psychology major. I’m a junior here at City College, and I think CUNY should be free because cost of living in New York City is notorious for being so high, and between that, tuition, and MTA fares, there’s not really space for you to use that money for anything that you need or anything for you to move around financially, and it’s becoming really depressing, people are moving out of New York City and people are not enjoying New York City and hustle culture as toxic as it is.

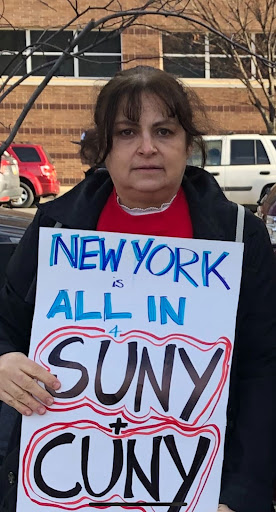

Posts Tagged ‘transit’

Amirah Alwagih, City College of NY

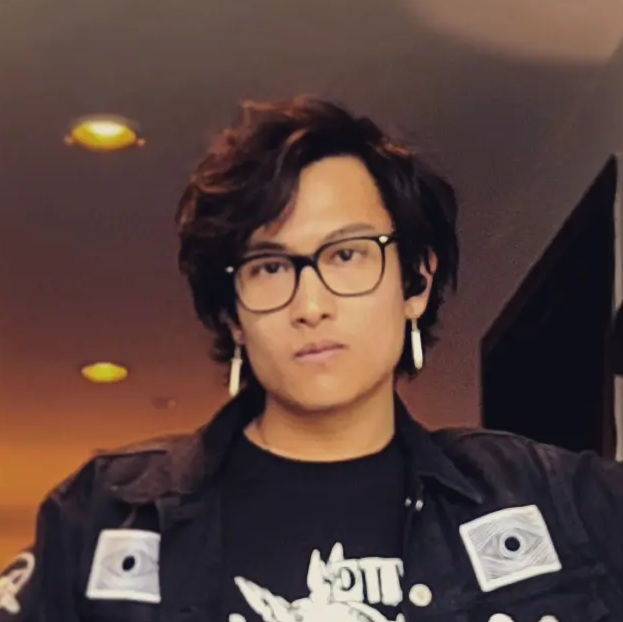

Justin Yulo, City College of NY

I’m student here at City College New York and I think I can benefit from a free CUNY and more importantly other students can benefit from a free CUNY because the cost of going to university here, while CUNY is an affordable university, it is still pretty expensive for some, especially low income families. In my case I still have to take out student loans, in the 10,000s attending here, and even right now I still have to take a part time job just to pay for some of the expenses like the transport and travel with my metrocard and overall I think a free CUNY builds an important part of our society which is the next generation coming up and learning in such a prestigious university that boosts communities.

Sadia, Borough of Manhattan Community College

I am an international student at BMCC so I pay a lot of money for school. I remember a few days back at Chambers Street and BMCC, the train tracks caught fire and we were struggling to get out of the train station. The OMNY TAP wasn’t working to get in another station, and I didn’t have anymore money on my card. Unreliable trains have caused me to be late so many times. The A train sometimes delays from Broadway Junction. There have been more than a few times that I was 10 minutes late to my class because of the subway. A previous semester, I had 4 classes. Four days a week coming back and forth is about 20 dollars a week. And I think that is too much. I think they should make it more affordable for people who need help, so that they can get to class.

Mohammad Haikel, College of Staten Island

I am a student at College of Staten Island. Public transportation has caused me to be late a couple times where I needed to take the bus to school and I was late to a final. And it’s the same situation when I’m going to work. Free or reduced price transit would save the stress on myself and other students in general.

Guillermo Davila, Borough of Manhattan Community College

I’m in my last year at BMCC, planning on getting my Associates Degree in the spring. My major is studio art and painting. I plan on transferring to a four year CUNY to get my BA in architecture. Right now, I am paying for school with the PELL grant and it is the last year I’m able to. I tried doing the TAP application this and last year, but even though I’ve been living in NY since 2020, for some reason they say that they cannot figure out if I qualify for TAP because of residency concerns. I’m a US citizen but I have lived most of my life in a different country. When I first came to NY I lived in the shelter system and that’s not enough to determine residency. I have an appointment with the HESC to sort this out, which I have been trying to have since last year. I am trying to sort this out now, but it has been a difficult and long process to figure out. I’ve had two appointments with HESC so far and nothing has changed yet. The PELL grant covers all of my tuition, but still it’s not enough because I have other costs such as rent, groceries, school supplies, and transportation. Last semester, I enrolled in the work study program so I could get some extra money but this semester I did not see that option in my financial aid. What I am going to try to do this semester is find a part time job to cover costs? I am applying for TAP so that I can have all of these costs covered so that I can focus on school. Because I have my tuition covered with the PELL grant, mostly food costs are the problem NY is expensive. My SNAP benefits do not cover this.

Charlene Perez, College of Staten Island

I am a student at the College of Staten Island. Where I live, the bus takes really long. Sometimes the bus doesn’t even stop. It’s a very common experience. I have classes on Tuesdays and the bus gets so full that they don’t even stop. I take two buses, so that bus made me late for class. I take the bus everyday to get around. Lower fares would make a huge difference, especially because they raise the price. It all adds up every day, week, and month.

Caroline Scott, SUNY Cortland

I attend SUNY Cortland as a full-time student. I’ve been here for two years and attended SUNY Broome my freshman and sophomore year. When applying for college I didn’t know where I wanted to go, but I knew that I didn’t want to be that far from home. That’s why I decided on Broome because it’s about 30 minutes from home. I was able to live off campus and not commute so I was able to get a real college experience. After two years there I decided to go to Cortland because it was far from my home where I am able to be independent, but still close enough to go home if I need to. I am able to go to Cortland without having to have student loans because my parents can pay for it in full. That is a reason why I chose Cortland because I wouldn’t have student debt. Cortland comes with a lot of expenses though whether it’s parking, the price of textbooks (which I don’t always need), or materials teachers make us get outside of the classroom. My major is important to me so I will do whatever it takes to obtain my degree, but the price for many things have gotten out of control and I believe all SUNYs need to look at their finances and think about their students.

Ines Schmitt, Hunter College

I am a senior at Hunter College and a Psychology major. I am a mother of three going back to school now my children are grown up and would like to help young people since when I was young I didn’t have that support. I was at BMCC my first two years and I got my associate’s degree. It was really nice because I didn’t have to worry about the burden of paying for my tuition books and transportation since I had ASAP with an unlimited metrocard and I had an excellent adviser. Unfortunately when I transferred to Hunter I didn’t have the same experience with the advisement. They made me take a class that I already took in BMCC and I felt that the adviser didn’t take me seriously. I had to take that class online with 300 other students and I didn’t learn anything since the professor couldn’t take the time to explain. I think one of the changes that CUNY could benefit from is extending ASAP since it is a great program to hire more advisers that care about students instead of making it more difficult. Fixing the heating system since sometimes the professor had to let us leave because it was too hot and there wasn’t anybody to put the heating down. I think going to university shouldn’t be a struggle and administration should help us to navigate the system.

Donald Glivens, Borough of Manhattan Community College

I am a senior at BMCC and I am majoring in Business Management. I am planning on continuing my education at a four year college to get my bachelor’s degree. I live with my parents, but they can’t afford to pay for my college expenses. So I have to take out loans in order to pay for my education. I take out subsidized loans through FASFA. It covers all of my school expenses but it doesn’t cover my textbooks, transportation, or food. Also, I have to help support my family, so I have to work two jobs to afford other expenses. This makes it difficult for me to concentrate on my education. In order to graduate I needed to take a certain class that wasn’t offered my last semester. This forced me to take out more loans because I had to go to school for an extra semester. I am really worried about paying these loans back in the future. I wish they would make college free for everyone, so I wouldn’t have to be so overwhelmed about paying for my education.

Emma Gutowski, SUNY Cortland

I attend SUNY Cortland as a full time student. I am currently a senior but have been attending school here since I was a freshman. I am from Corfu, New York. When I started considering colleges and going through my options I made sure to keep my parents in the loop as they are the ones who pay for my schooling. I first considered two private schools in different states but as time passed I realized that the tuition cost would be far too much so I began to focus on SUNY schools. When the time came, I ultimately chose Cortland. It felt right and once I heard about their Professional Writing major, I was sold. Once Covid-19 hit, all of my classes were online except for one science lab but I was already on campus so I couldn’t do much to change it. The second semester of my freshman/sophomore year (I am graduating early so it gets a bit complicated) I stayed at home and did all of my classes virtually. Although that first year was tough, it was helpful to my family as we didn’t have to pay the living on campus fees and we received a lot of refunds since I wasn’t using the campus amenities. That semester at home was also the hardest for me grades wise. I began to work while taking these classes and strained myself too much. Ever since then my grades have improved massively and I’ve continuously made the dean’s list. I will say that the toughest part about going to college is the tuition and figuring out how these student loans will affect me in the future. I usually have a discussion with my mom before I move back to school about how we are going to pay for school and although she always figures it out, it’s still a very stressful situation. There should be changes to tuition and what fees are included. I was never a fan of dining hall food so having to pay for a meal plan I barely used felt ridiculous to my family. The amount for a parking pass should also be lowered due to the fact that they will sell way over how many actual parking spots there are on campus. My experience here has been great and I will miss it when I graduate in the spring.